National savings is pleased to announce that the profit rates of National Saving Schemes have been revised upward with effect from 1st July 2019 till further notification.

Profit rates effective from July 2020; https://www.opfblog.com/35654/slight-increase-in-national-savings-profit-rates-july-2020/

Also Read: https://www.opfblog.com/35086/national-savings-reduce-profit-rates-from-nov-2019/

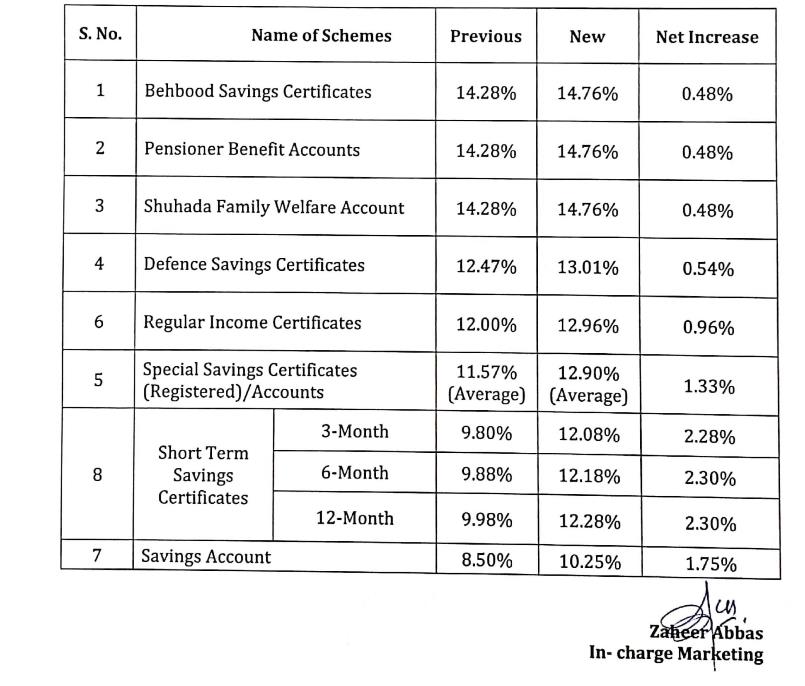

Following are the details of revised NSS rates

Bahbood Savings profit rates

Click here for profit rates on Defense Saving Certificates

Click here for profit rates on Special Saving Certificates

Click here for profit rates on Short Term Saving Certificates

Click here for profit rates on Regular Income Certificates

Please clarify what will be the With Holding Tax % on profit in case of Nonfilers

Sir minimum kitna investment hoti ha monthly kitna profits ha

New PBA rates kaun se months se revised hua hain ,q k is silsly me koe notificatin jari nahi hua.thanx

Bhatti sahib

Rates 1st July 2019 say revise ho chukay hein. Notification 4th July 2019 ko jari hua thaa.

1 July 2019 say. Notification 4 July ko jari ho chuka hay

I purchased DSC in January 2019 for ten years, now I have to withdraw this amount so I may be guided either I am eligible for 06 month profit at normal rate or not? Whereas Income Tax Authorities are in practice to recover withholding tax on profits on half yearly basis sarwarjlal@gmail.com

Sir g muj sa aaj sohawa NSC walon na katote ke hai ma na jab oun sa poochha too kaha k tax Kat leya gya hai

My understanding is that Profit Rate of Regular Income Certificates are fixed at the rate applicable on the date of purchase and it will remain constant till the maturity of the Certificates. In other words any increase or decrease in the rate does not have any impact on existing RIC holders. The new rates will apply to new Investors. Admin’s comment in response to Khalid’s query regarding RIC rate to the effect that ” From first July new rates” might create confusion to existing RIC holders. Admin needs to clarify this matter to other readers. I am fully aware of the situation and do not need any explanation.

Syed Mahboob Alam sahib

Thank you for the clarification. I am removing my comments and will cross check with National Savings as well.

Sir main janana chahta hoon pensionor sa kitne % tex ke katote ke Jae gi aur salana ho gi ya mahana

Zahoor Shah sahib

Nahin hogi

Sir what is different failure and non failure

Failure means ناکامی

Non-failure means

ناکام نہ ہونا

Can confirm,wether Income taxes are applicable on profit on BSC and PBA accounts, if than how much in July 2019 policy. Thanks

What I have been told by a lawyer dealing with income tax matters, that income from PBA and BSC is tax free but will be included in tax return.

Salaam sir

Humko sirf yeh bata dain Keh Qoumi bachat main ab 1 lakh per Kitna profit saafi milay ga.Baqi yeh yaad rakhain Keh khuch gareeb loogon ka guzar basar issi profit per hay Jesa Keh widdos Jin Kay husband ni hain ya jin ka koi kamanay wala ni hay mujhay jawab chaheay woh loog ya ortain ab Kia Kia kerain Keh unkay ghar ka nizaam chal sakay. 00966582540413 meray whatsapp per jawab bhi day saktay hain. Thanks