National savings is pleased to announce that the profit rates of National Saving Schemes have been revised upward with effect from 1st July 2019 till further notification.

Profit rates effective from July 2020; https://www.opfblog.com/35654/slight-increase-in-national-savings-profit-rates-july-2020/

Also Read: https://www.opfblog.com/35086/national-savings-reduce-profit-rates-from-nov-2019/

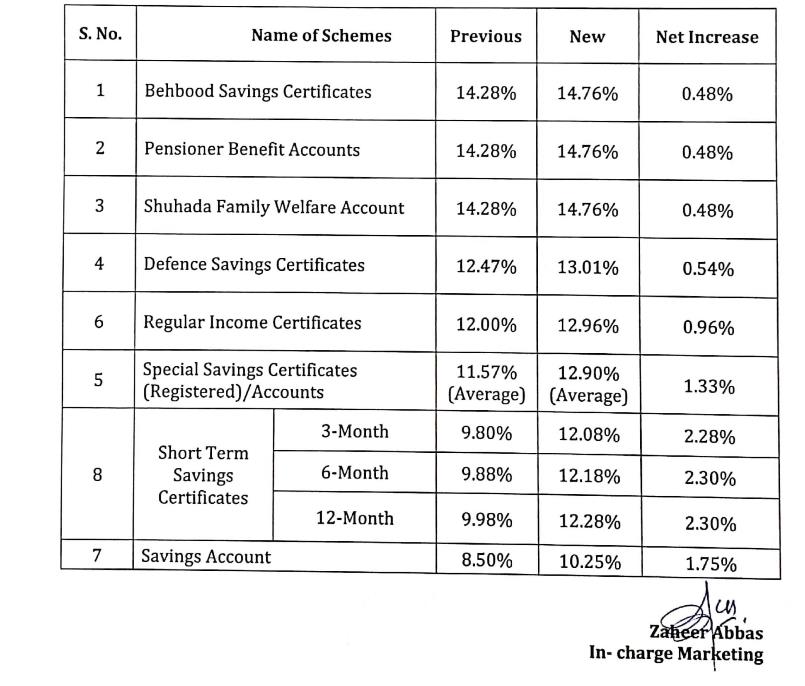

Following are the details of revised NSS rates

Bahbood Savings profit rates

Click here for profit rates on Defense Saving Certificates

Click here for profit rates on Special Saving Certificates

Click here for profit rates on Short Term Saving Certificates

Click here for profit rates on Regular Income Certificates

I have one question Please early and positive reply

– Before increase profit investor own Behbood certificate profit was 14:28% after increased profit goes up 14:76% so older investors will get new profit rate this is understood

– Question is if profit rate will revise and profit rate decreases from 14:76%

So what will happen with Old investors they get which % of profit

-same 14:76% or new less rate

for sure not less than original rate at the time of purchase of certificate

Your reply will appreciate

Iqbal

u will get new profit but u will also have to pay new tax on profit if filer 15% if non filer 30%.thats wat i learnt from NSC today

please explain to me under new rule -on RIC previously I paid 10% WHT .Now as per new rule i will pay 15% if i am a filer & 30% if i am not a filer.also please explain to me what does it mean 15% on profit upto or less than 5 lakhs & 30% if profit more than 5 lakhs .

Suppose i have 1crore & 30lakhs in RIC -What amount shd i get in july’19.the new rate is rs:1080 -12.96% if they cut 15% wht -i am a filer

suppose i have 2 crore & 50lakhs in RIC -What amount shd i get in july”19 ” ” “

Rukhsana sahiba

Tax whatever the percentage, will be deducted on profit not on invested amount

Please send an email to info@savings.gov.pk or call National Savings directly at 051111267268 for details.

I have uploaded latest notification regarding withholding tax.

Thank you for responding to my query .what about Pension benefit account .no WHT on that too??

No tax on PBA as well

Sir, I have found great rush of people in saving centers, specially at Gulistan e jauhar center. Cant it be solved by means of transferring their profits direct in to their bank accounts?. Thanks.

No withholding tax on BSC and PBA. Moreover profit on these BSC and PBA Is shown as Non taxable income in final tax return.

i thought there is no tax on behbud certificates & on pension fund

Rukhsana

that is right;

Withholding tax is not collected on the profit earned on BSCs. Investments made in the BSC are also exempted from Zakat collection.

The new rule of taxation on investment would apply on old deposits in bahbood certificates?

Bahbood Certificates are exempt from withholding tax, until now there is no official announcement about any amendment in the policy.

Thanks PTI / current Government

I am holding some regular income certificate, do I get the profit on new rate or old rate